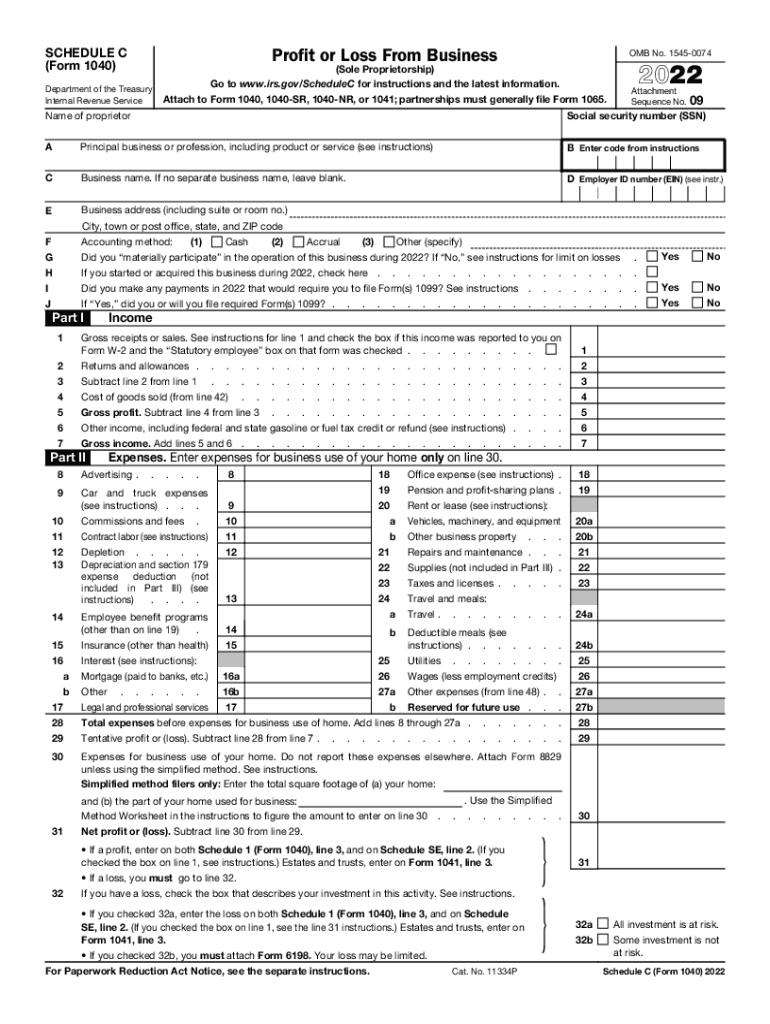

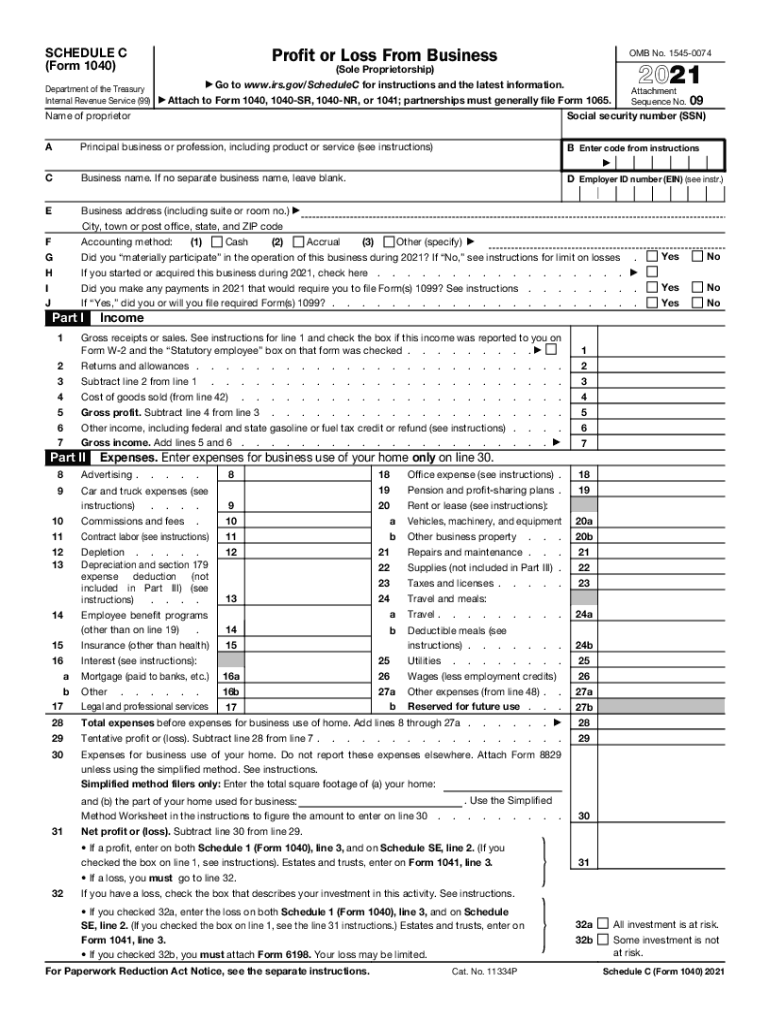

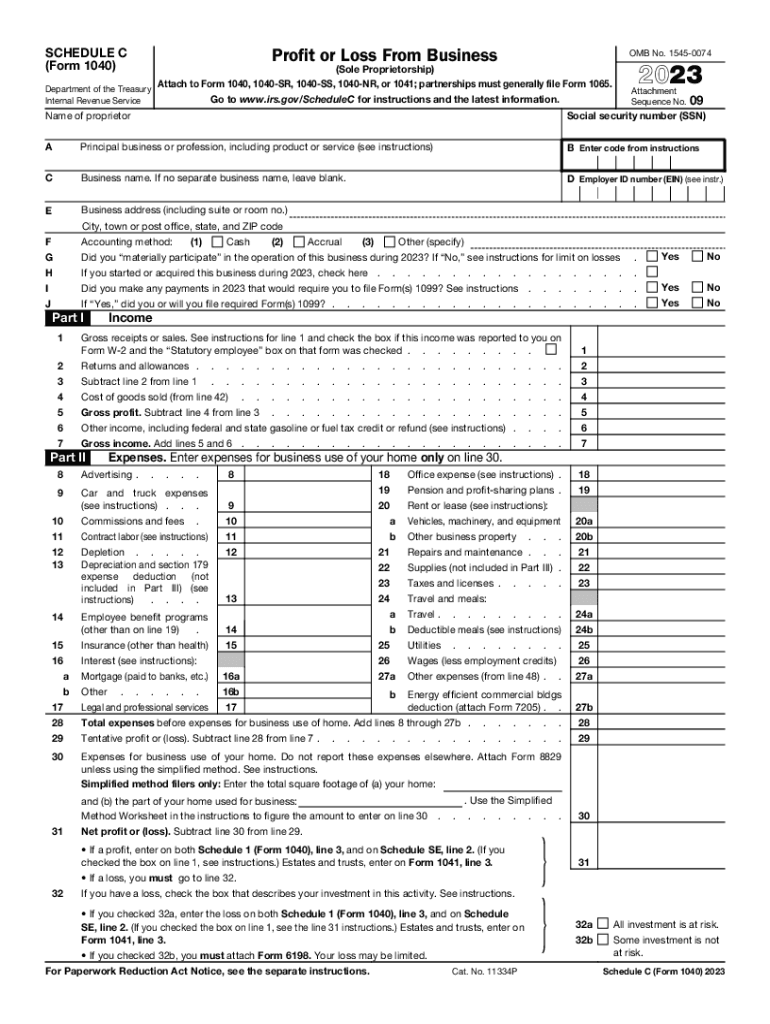

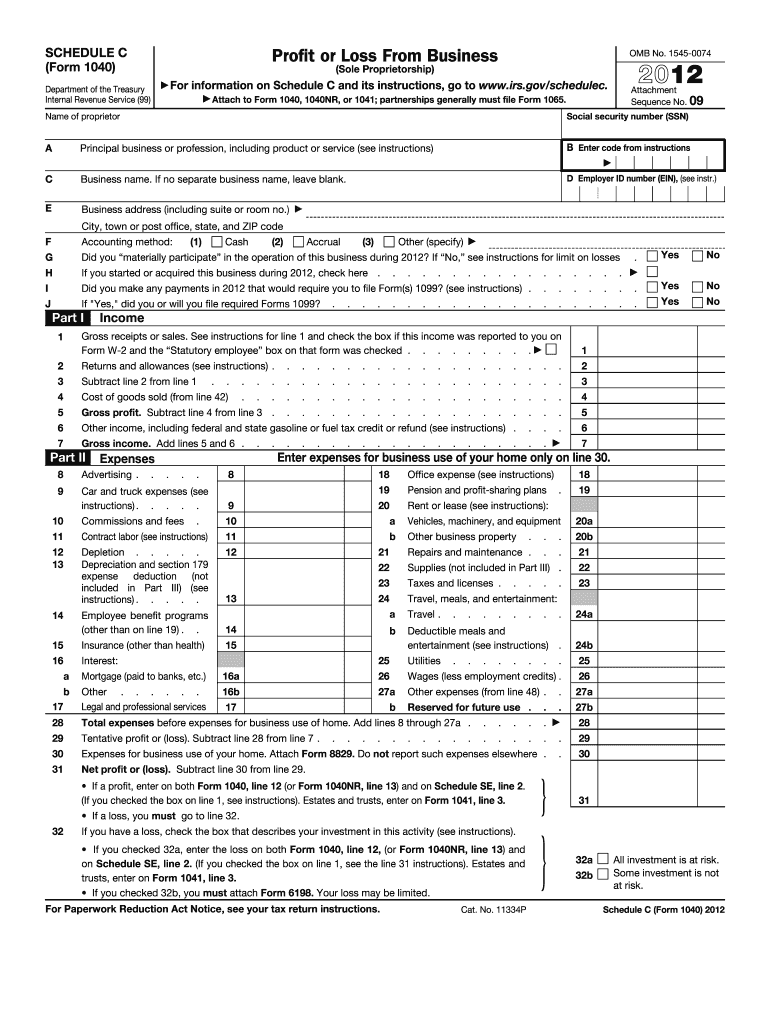

Schedule C 1040 Form 2024 Pdf – You take the deduction on Schedule C if you are self-employed or a sole proprietor, or as an itemized deduction on Form 1040 if you are an employee. Business-related meal expenses for employees . Attach the Schedule C to your regular form 1040. Submit the forms to the IRS. There is no need to indicate on your Schedule C that you are closing your sole proprietorship. Tips Do not submit a .

Schedule C 1040 Form 2024 Pdf

Source : www.dochub.comSchedule C (1040 form) | signNow

Source : www.signnow.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.coIRS Schedule C (1040 form) | pdfFiller

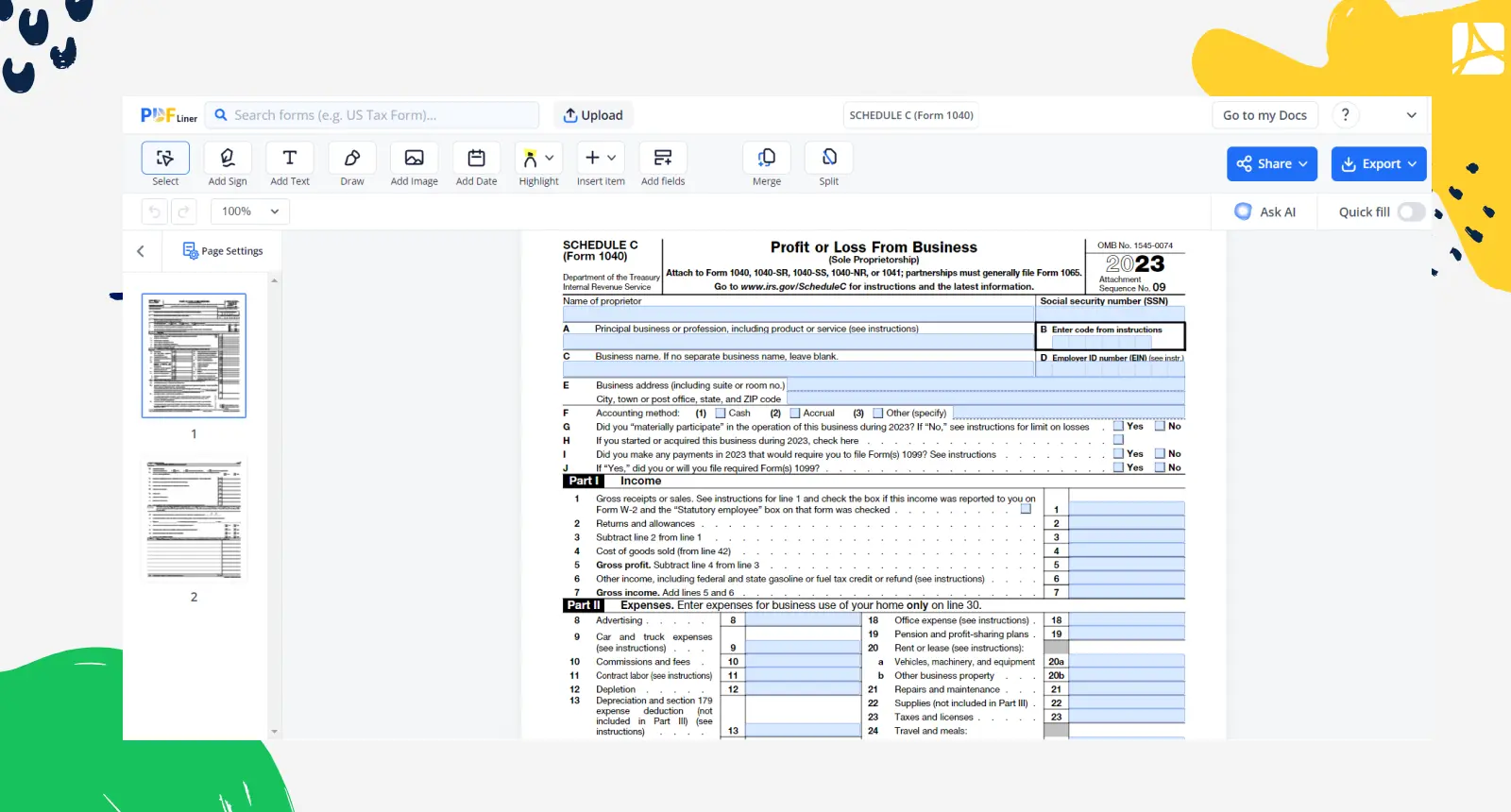

Source : www.pdffiller.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat is an IRS Schedule C Form?

Source : falconexpenses.comprofit or loss from irs form 1040 schedule c: Fill out & sign

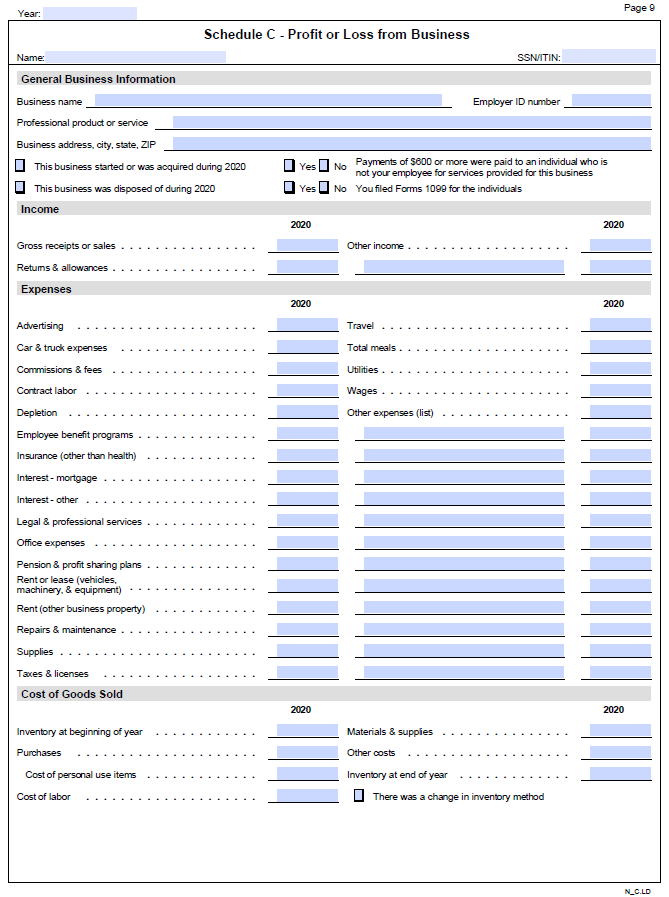

Source : www.dochub.comSchedule C Small Business Organizer Daniel Ahart Tax Service®

Source : www.danielahart.comSchedule C 1040 Form 2024 Pdf 1040 gov: Fill out & sign online | DocHub: The 2024 primary schedule is listed below with the date of each state’s primary and caucus for Democrats and Republicans in the 2024 presidential primary. . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

]]>